An astounding 64 million Americans said they don’t read their paycheck stubs.

Pay stubs can stop you from being shortchanged or owing a ton of money to the government. Below we’ve compiled five important reasons you should be checking these documents.

We’ll also give you some tips on what it means to have withholdings, deductions, time-off accruals, and the importance of tracking your hours.

Track Your Total Earnings With Paycheck Stubs

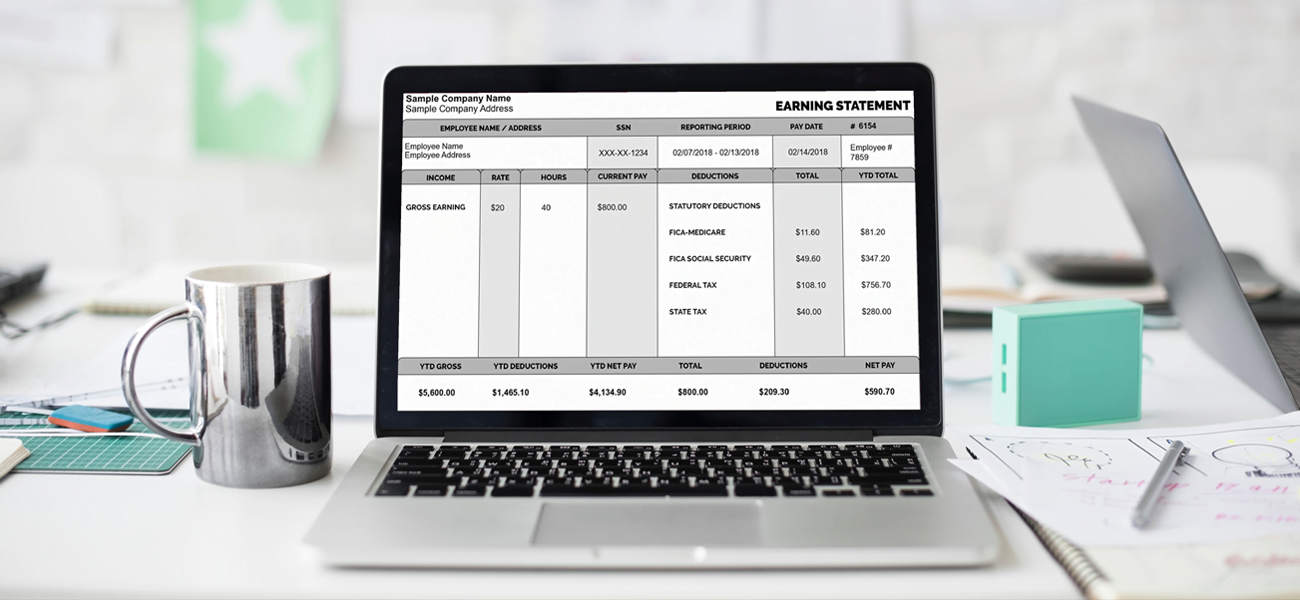

The purpose of a paycheck stub is to provide employees with proof of income. You should be regularly checking your stub to know exactly how much money you’re making.

For one, you want to check there haven’t been any accounting errors, and you need to know what you’re working with to budget properly.

Verify Your Paycheck Withholdings

When starting your job you completed a W4 to claim a withholding allowance.

The larger your withholding allowances, the smaller amount of income tax is deducted from each paycheck. You can make claims for children or larger investments.

What you select on the W4 will determine how much money you receive or pay at the end of the year.

Reading Your Paycheck To See Your Benefits

Besides your tax withholdings, money is also taken from your paycheck for benefits: healthcare, life insurance, or retirement savings.

These can get complicated and you want to track what’s being taken out of your pay. When making contributions to a 401K, for example, you can choose to do pre-tax or post-tax.

A Pay Stub Lists Your Time off

You love taking vacations, right? The best way to make plans based on your accrued time off is by reading your paychecks. Employers on average give approximately one vacation day per month. By the end of the year, this amounts to roughly two weeks.

The same type of policy goes for sick or personal time as well. If your employer doesn’t provide you with this documentation, suggest they try an online pay stub maker.

Recording Your Total Hours Worked

If you’re an hourly employee you must track total hours worked. If, for instance, you work over the hourly limit you should be receiving overtime. Your boss may require approval for that and you don’t want to get in trouble by not mentioning it.

It’s also important to track your total hours if you’re self-employed or work multiple jobs. You need to verify that you’re paying the correct amount of taxes for all of your jobs, otherwise, you could end up paying the IRS on April 15.

Stop Disregarding Your Pay Stubs

Let’s be honest, most people take the check and throw out the stub. Stop doing that!

Not only should you be reading your paycheck stubs to see that everything is correct but you need to save them all for tax season. You never know when you’ll be asked to provide documentation.

Are you an entrepreneur who enjoys reading the latest tech tips and gadget news? Check out the rest of our website to stay ahead of the pack on the newest products.