[ad_1]

Taber Andrew Bain / Via Flickr: andrewbain

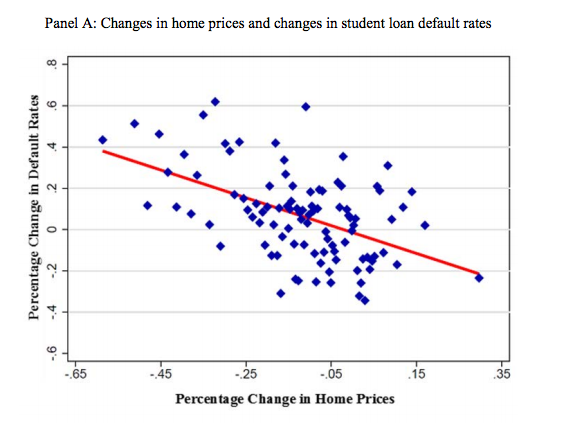

The collapse in housing prices during the Great Recession was directly responsible for at least a quarter of the increase in student loan defaults from 2007 to 2010, according to a new study that examined granular geographic data.

While many reports have tied defaults to the rise in “non-traditional borrowers” — older students who go to for-profit schools with dubious educational results and then default on their loans — New York University economists Holger Mueller and Constantine Yannelis argue that the recession and housing collapse was also “a first-order, and highly salient” explanation for why some areas saw bigger rates of defaults than others.

The drop in home prices “accounts for approximately 24% to 32% of the increase in student loan defaults,” the authors estimate.

Looking at a group of about 1 million randomly selected borrowers over time, the researchers found a link between home prices and student loan defaults on the zip code level. For every 1% decrease in home prices in these areas, there was an increase in defaults. Between 2006 and 2009, home prices dropped 14.4% in the zip codes they looked at, and between 2007 and 2010, new student loan defaults jumped 19%.

“As home prices began to plummet at the onset of the Great Recession, student loan default rates began to rise,” they wrote. The collapse in home prices starting in 2007 helped tank the economy; the labor market got worse in zip codes where home prices fell more; borrowers in those areas defaulted on their student loans.

NBER / Via papers.nber.org

Those who were most likely to default were borrowers with low incomes and high amounts of outstanding debt. Many were eligible to get relief from the Education Department's Income Based Repayment (IBR) program — which was introduced in 2009 and allowed borrowers to pay off their loans based on their actual income, with a 15% cap on payments as a portion of income.

IBR “has led to a significant reduction in student loan defaults as well as their sensitivity to home price fluctuations” according to the study. The program targets low-income borrowers who are most likely to default when they face prolonged unemployment.

Borrowers who could have gotten IBR but did not continue to default at higher rates.

How America’s Student Loan Giant Dropped The Ball

Hundreds Of College Programs Could Be Shut Down For Breaking Student Debt Rules

The Trump Administration Is Delaying Enforcement Of For-Profit College Rules

[ad_2]